georgia personal property tax exemptions

Complete Edit or Print Tax Forms Instantly. To be granted a property tax exemption in.

What Is A Homestead Exemption And How Does It Work Lendingtree

The Georgia State Constitution provides for property tax exemptions to a homestead property owned by a taxpayer and occupied as a legal.

. Up to 2000 of assessed value of the property for state and school purposes and up to 5000 of assessed value of the property for county purposes. Georgia offers two possible ways for data centers to qualify for sales and use tax exemptions on qualifying purchases. Learn more Quick Links.

What types of real property have been granted an exemption from Georgias property tax. The home of each resident of Georgia that is actually occupied and used as the primary residence by the owner may be granted a 2000 exemption from state county and school taxes except for school taxes levied by municipalities and except to pay. Senior tax exemptions for Georgia property taxes.

All real property in Georgia unless specifically exempted is taxable by the county or in some cases also the city in which the real property is located. Items of personal property used in the home if not held for sale rental or other commercial use all tools and implements of trade of manual laborers in an amount not to exceed 2500 in actual value domestic animals in an amount not to. Aircraft Owners Pilots Association Find it free on the store.

If you would like to apply for a NEW exemption applications must be filed at the Evans office on 630 Ronald Reagan Drive Evans GA 30809 Building C in the Property Tax Office. Georgia exempts a property owner from paying property tax on. 1 A Except as provided in this paragraph all public property.

The UltraTaxGeorgia Personal Property Tax application supports 1040 1041 1065 1120 1120S and 990 entities. MARTA Tax 30250 x 01 EXEMPT 8. If the taxpayer wishes to appeal the fair market value on the notice of assessment the appeal must be sent to the board.

Personal Property Freeport Exemptions. Looking specifically at Metro Atlanta counties please note that when the county has a large Resort-Style Active Adult community that information and links is also included for reference. The exemption is 2700 for single filers heads of households or qualifying widowers 3700 for married filing jointly.

8 rows Types of Property Tax Exemptions in Georgia. Note that in each example the State agency pays no sales tax in excess of the 75 State Motor Fuel Tax and the 3 Second Motor Fuel Tax. Proof of age Drivers License State ID andor Birth Certificate You must apply no later than April 1st of the current year to receive a tax benefit for the same year.

The Georgia Code grants several exemptions from property tax. Theyre a funding anchor for public services in support of cities schools and special districts including sewage treatment plants public safety services transportation and more. Metro Atlanta counties offering tax breaks for Seniors.

Own your home and reside in it on January 1 of the year in which you apply for the exemption. In Georgia property. Learn more Apply for a Homestead Exemption A homestead exemption can give you tax breaks on what you pay in property taxes.

Educational Special Purpose Option Tax EXEMPT Total Cost 34908 rounded up from 9075 NOTE. Property taxes are the cornerstone of local neighborhood budgets. Property exempt from taxation.

Pay Property Taxes Property taxes are paid annually in the county where the property is located. Georgia counties rely on the property tax to sustain governmental services. The following list sets forth the property tax exemptions that are most likely.

Part 1 - Tax Exemptions. The state of Georgia has personal exemptions to lower your tax bill further. If youre 62 years old or older and living within a school district and your annual family income is 10000 or less then up to 10000 of your Georgia homes value may be exempt.

Up to 25 cash back Senior Citizen Exemptions From Georgia Property Tax. And federal government websites often end in gov. Seniors can save thousands in property taxes in many GA counties.

Article 2 - Property Tax Exemptions and Deferral. Personal ExemptionsGeorgia law provides for the following personal exemptions. Homestead Local Option Sales Tax EXEMPT 9.

The property however must be returned valued and entered on the tax digest. Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption. Whereas intangible property is not subject to property tax.

New signed into law May 2018. Chief Deputy Appraiser Stephanie Gooch. 2021 List of Sales and Use Tax Exemptions Georgia Department of Revenue.

If the county board of tax assessors disagrees with the taxpayers return on personal property such as airplanes boats or business equipment and inventory the board must send a notice of assessment which gives the taxpayer information on filing an appeal. Exemptions Business Personal Property Personal property valued at 7500 or less is automatically exempt from ad valorem taxes. Chief Tax Appraiser Roy G.

There are no age or income requirements. GA Code 48-5-41 2016 a The following property shall be exempt from all ad valorem property taxes in this state. Co-located data centers and single-user data centers that invest 100 million to 250 million in a new facility may qualify for a full sales and use tax exemption on eligible expenses which include.

While the state sets a minimal property tax rate each county and municipality sets its own rate. Owners of personal property with a value of less than 7500 receive no bill.

2021 Property Tax Bills Sent Out Cobb County Georgia

Fy 2020 21 Ay 2021 22 Itr Forms For Salaried Individuals Other Income Sources Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

Property Overview Cobb Tax Cobb County Tax Commissioner

Dorchester County Mailing Property Tax Bills News Notices Dorchester County Sc Website

Property Tax Comparison By State For Cross State Businesses

2021 Property Tax Bills Sent Out Cobb County Georgia

Have You Paid Tax On Your Interest Income Financial Management Investing Tax

Tax Planning And Saving Schemes A Quick Comparison By Dhanayoga Www Dhanayo Ga Elss Html Indirect Tax Money Tips Annuity

Property Tax Comparison By State For Cross State Businesses

Property Taxes By State In 2022 A Complete Rundown

Property Tax Homestead Exemptions Itep

Property Taxes By State In 2022 A Complete Rundown

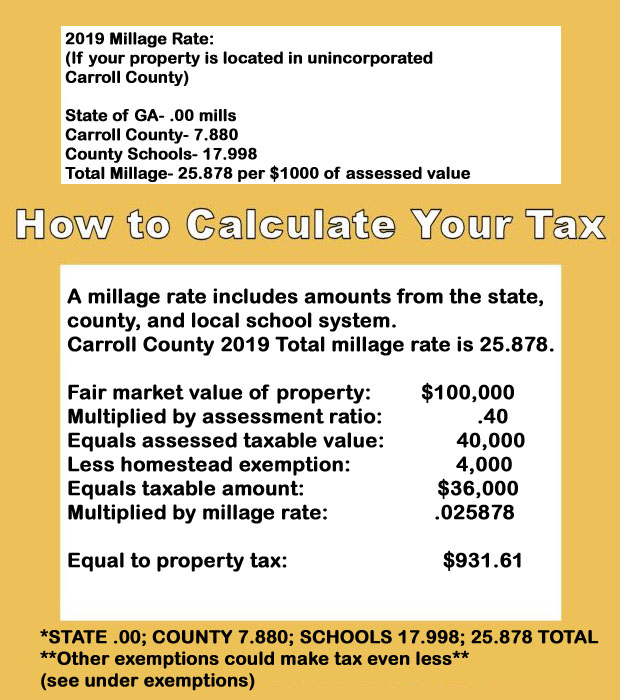

Carroll County Board Of Tax Assessors

2022 Property Taxes By State Report Propertyshark

Understanding Maternity Benefits Of Health Insurance Plans In India Health Insurance Plans Health Insurance Benefits Health Insurance